Probate is the court-supervised process of dispersing a deceased individual’s properties after their fatality. The probate court supervises the transfer of property to make certain the deceased person’s financial obligations are paid and their assets are transferred to individuals qualified to obtain them.

Probate can be a challenging, extensive, taxing procedure. However, in circumstances where the departed person’s possessions are below a legal threshold, the estate may qualify for a streamlined estate management procedure.

If you just recently shed an enjoyed one and are beginning the probate procedure, Nevada probate lawyer Natalia Vander Laan can review your scenario to identify whether your liked one’s estate receives streamlined management. Regardless of the probate process you have to adhere to, Ms. Vander Laan can raise this worry and manage the estate administration process so you and your family can focus on the grieving process.Ссылка oklahoma affidavit of small estate guide [2] сайт

Small Estate Probate in Nevada

A person that passes away with a Will is said to have actually passed away ‚testate.‘ Commonly, their Will certainly recognizes a person that will certainly function as the Estate Executor.

Someone who passes away without a Will is said to have passed away ‚intestate.‘ When a person passes away intestate, the probate court designates somebody to serve as the Estate Administrator.

The Estate Executor or Estate Manager is accountable for managing the departed person’s estate. Generally, this implies they should open an estate in the court of probate of the nation where the departed individual died. They need to take a stock of estate possessions, pay any kind of financial debts and taxes the departed individual owed, and distribute the staying properties to individuals called in the deceased individual’s Will or the people that are qualified to get the deceased individual’s property under Nevada legislation’s intestacy regulations (the deceased individual’s successors).

In particular circumstances, the estate may receive a streamlined probate procedure. If the overall gross worth of the estate is less than $300,000, the estate might get Summary Administration. If the estate is valued at less than $100,000, it may get approved for Set-Aside Probate. And for estates valued at less than $25,000 (leaving out the value of any type of vehicles) that do not include real estate, the estate representative might only require to submit an Affidavit of Privilege.

Recap Administration for Estates Valued at Less than $300,000

If the decedent’s estate is valued at less than $300,000, the estate agent can request a Summary Management of Estates. Summary administration does not prevent probate completely, yet it is an extra streamlined procedure that can conserve time and probate fees.

The key advantages of a Recap Management are:

- Financial institutions have to present cases versus the estate within 60 days, rather than 90 days in a general management.

- The need to release a notice of the application for probate in a newspaper is waived.

Probate Court Set-Aside

For estates valued at less than $100,000, the probate court can buy that all or part of the estate be ‚reserved without management‘ so estate assets can be dispersed directly, in the complying with order or priority:

- To pay lawyer’s fees

- To pay funeral costs, the expenses of a last illness, and any money owed to the Division of Health and wellness for Medicaid repayment

- To pay financial institutions

- To individuals that inherit under a Will or, if there is no will, under Nevada intestacy legislations

If the departed person left a surviving spouse or minor youngsters, the court will usually allot the whole estate for the partner or small kids without first paying lenders.

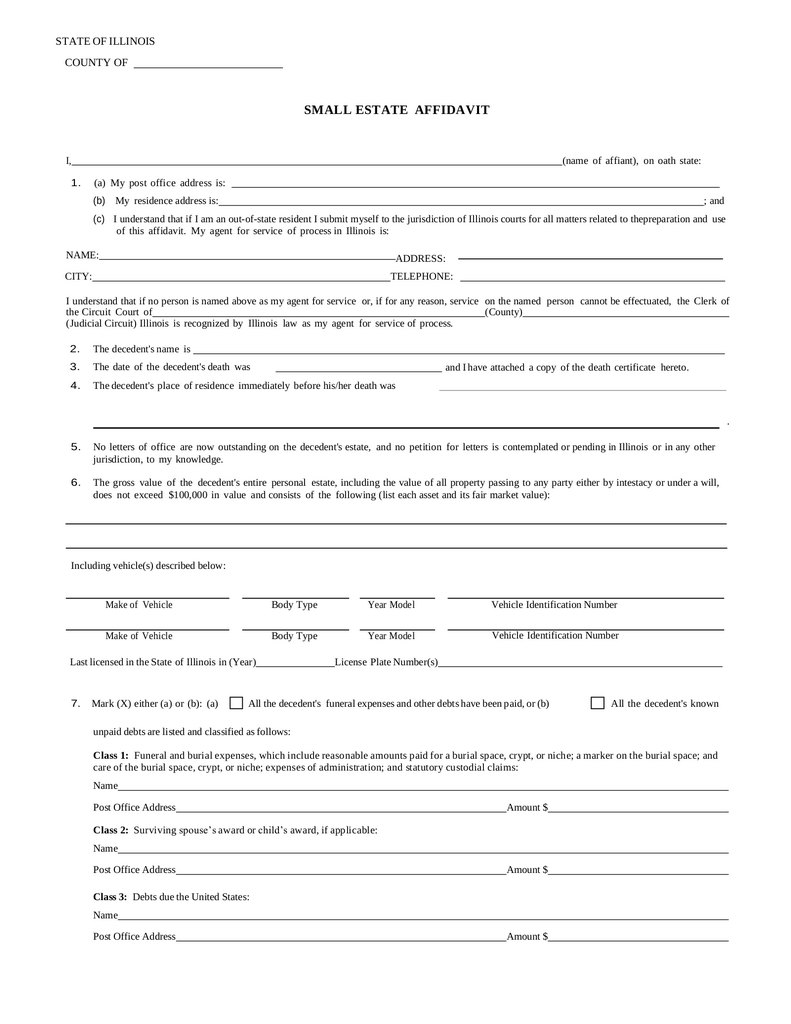

Nevada’s Small Estate Sworn statement

Nevada’s Small Estate Testimony procedure permits inheritors to avoid probate completely. To qualify, the estate must meet the following needs:

- The overall value of the estate is less than $25,000 ($100,000 if the individual submitting the Small Estate Sworn statement is the deceased person’s surviving spouse)

- The dead individual did not own real estate

- No petition for the consultation of a personal rep is pending or has actually been provided in any kind of jurisdiction

- At least 40 days have actually passed since the person’s fatality

If the estate fulfills these requirements, the inheritor can file a Small Estate Affidavit. A minimum of 14 days before submitting the Small Estate Sworn statement, the inheritor has to give any other recipients with created notice of the case and a summary of the property to be transferred.

After signing the document and having it notarized, the inheritor offers the testimony to the individual or institution that holds the deceased person’s property, typically with a duplicate of the death certificate. After that, the person or organization holding the residential or commercial property must release the property.

Contact The Vander Laan Law Office for Small Estate Probate in Nevada

If you require help with Small estate probate in Nevada, Natalia Vander Laan can assist. Ms. Vander Laan is a seasoned probate and estate preparation lawyer that proudly serves the Carson Valley.