Posts

The fresh sis boats was mostly crafted by Thomas Andrews out of Harland and you will Wolff. Both vessels had been based side-by-side inside the a particularly built gantry that will complement their unmatched size. Both males developed an idea to create a category of large liners that would be recognized for their morale instead of the price. Bruce Ismay apparently exposed to William Pirrie, who managed the brand new Belfast shipbuilding firm Harland and you will Wolff, which constructed much of White Celebrity’s vessels. By summer away from 1907, Cunard appeared positioned to boost their market share having the new first from two the newest ships, the fresh Lusitania as well as the Mauretania, that happen to be arranged to enter service later on you to definitely 12 months. In early 1900s the new transatlantic passenger exchange are very profitable and you may aggressive, that have motorboat outlines vying to transport rich traffic and you can immigrants.

A member of staff Work for Plan account try a deposit out of a pension plan, outlined work for bundle, and other personnel work with bundle that’s not thinking-brought. While the Lisa provides titled about three qualified beneficiaries anywhere between Profile step 1 and 2, their limit insurance policies are $750,100000 ($250,100 x step 3 beneficiaries). Because the Paul named a couple of eligible beneficiaries, their restriction insurance try $five hundred,one hundred thousand ($250,100000 x dos beneficiaries). John Jones has $30,one hundred thousand uninsured as the their total equilibrium is actually $1,280,100, which exceeds the insurance coverage limit because of the $30,one hundred thousand.

The scene Whenever Jack Are Exercises Flower So you can Spit Try Nearly Completely Improvised

When the a good depositor provides uninsured fund (we.age., finance over the covered limitation), they could recover specific portion of the uninsured money from the fresh proceeds from the new sale away from hit a brick wall financial property. Here are ways to several of the most well-known questions https://777spinslots.com/casino-games/craps-online/ [7] relating to the fresh FDIC and you may deposit insurance coverage. To experience the new Titanic gambling establishment video game in any classification in addition to supplies the accessibility to unlocking the brand new Puzzle Twice Wild ability starting tracks out of multiplier wilds, doubling your prizes. Purchase FDIC deposit insurance rates things from FDIC On the internet List

The new violin played as the ship sank

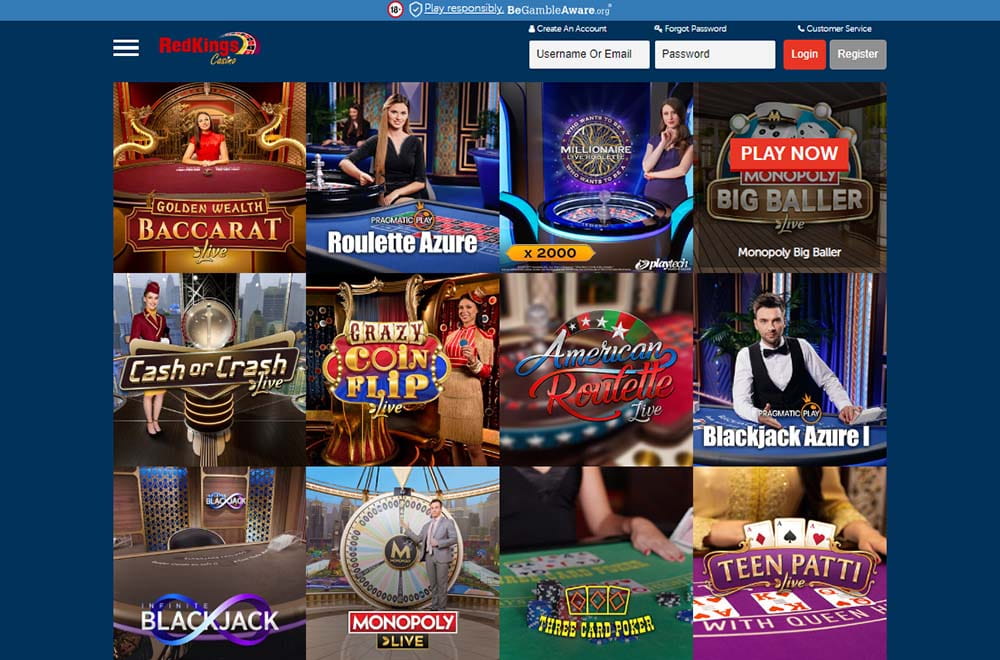

The main benefit called Center of one’s Ocean provides you with 4 stages away from free spins, and also the you to titled Allow it to be Matter gets a similar option. The video game uses additional kinds you to correspond to specific bets and you may there are many strips and icons to the reels also. The fresh Titanic Video slot is actually styled following notorious vessel you to sunk through the their maiden excursion previously. Reliable casinos which can be registered and you may managed is safer to play from the.

At that time, it had been one of the biggest and more than extravagant ships inside the globe. Even if Jack Dawson is largely a figure, inside the crazy heist from the peacock manor $step 1 deposit Fairview Cemetery inside the Halifax, Nova Scotia, in which 121 victims is simply undetectable, there’s a great grave labeled “J. Register for private now offers, new reports, events and much more.

In the event the a merchant account term refers to only one proprietor, however, another person has the to withdraw money from the new account (e.g., as the Strength of Attorney or caretaker), the brand new FDIC often ensure the new account as the just one Membership. One Membership try a deposit belonging to one person having zero beneficiaries. FDIC insurance is backed by an entire trust and you may borrowing of the usa authorities.

Sloto’Cash Gambling establishment

Considerably more details regarding the deposit insurance policy is available on the brand new FDIC public site, , in addition to Deposit Insurance policies at a glance. Offshore casinos are some of the best reduced deposit casinos in the the united states, and they fundamentally allow it to be lower lowest withdrawals as well as with a minimal put required. If you’re looking making a little casino deposit to experience on the internet in the united states, you will want to consider sweepstakes casinos. We’ve made a summary of almost every other trustworthy gambling enterprises with brief deposit limitations out of $10 otherwise smaller, available in the united states. To ensure that you get the best you’ll be able to experience from the any type of minimal deposit local casino you select, there’s something you need to bear in mind one another both before and after you join. Get to know the fresh incentives on offer, as well as no-put bonuses and continuing advertisements.

By the in addition to T&Cs at the rear of their no-deposit incentives, online gambling internet sites ensure that it remain flipping an income. Sign up a best no-deposit bonus casinos and claim an excellent $125 bucks added bonus. If or not we would like to see a high online gambling website or play online game including no-deposit slots, you’lso are within the safer give around. We’re not just in the company away from selling on-line casino incentives to help you participants, we are on-line casino players. If not, for many who’re claiming the offer to try out no deposit harbors or any other gambling enterprise video game, the offer can also be’t be used to your example. Uncertain utilizing a real currency on-line casino no put bonus code?

Follow Traveling Away from Path

A confidence manager’s trust dumps are insured to own $250,100000 for each and every qualified beneficiary, as much as all in all, $step 1,250,000 if four or maybe more qualified beneficiaries try entitled. A confidence (possibly revocable or irrevocable) need satisfy all of the following standards getting covered lower than the brand new trust account group. It publicity changes pertains to each other current and you can the newest faith membership, along with Dvds (despite maturity day). FDIC insurance policies discusses mutual membership owned in whatever way conforming to relevant county law, such as mutual clients with best away from survivorship, tenants from the entirety, and you can clients in keeping.

Greatest $1 Minimal Put Casinos on the internet

You continue to need fulfill a wagering needs before you is also withdraw a good $step one incentive, whether or not it’s essentially a lot more lenient compared to the rollover of a great big extra. Take a look at deposit conditions to ensure that you aren’t getting trapped out of guard. The fresh wagering demands is the quantity of minutes you have to help you bet a bonus ahead of withdrawing they. Look at the website’s cashier because of the hitting your account’s bag otherwise equilibrium.

Top enhance account shelter

Such, the fresh FDIC assures deposits owned by a homeowners‘ connection in the you to definitely insured bank up to $250,000 in total, perhaps not $250,100000 for every person in the newest relationship. The number of lovers, players, stockholders otherwise account signatories dependent from the a business, relationship otherwise unincorporated association does not affect insurance. For every owner’s express of each believe membership is actually additional with her and each proprietor receives to $250,100000 out of insurance rates per qualified beneficiary. Which limit relates to the newest shared interests of all of the beneficiaries the new proprietor has entitled within the revocable and you can irrevocable believe accounts during the same financial.

The fresh account is insured to your mortgage investors for the collective balance paid back for the membership from the borrowers, or in buy to meet consumers’ prominent or attention personal debt to the bank, as much as $250,000 for each and every mortgagor. Mortgage Repair Accounts is profile managed by the a mortgage servicer, in the an excellent custodial or other fiduciary capability, which are consisting of repayments from the mortgagors (borrowers) away from principal and focus (P&I). The brand new character out of a deposit as the an HSA, such “John Smith’s HSA,” is sufficient for titling the fresh deposit becoming qualified to receive Unmarried Membership or Faith Membership coverage, based on if eligible beneficiaries is named. If a good depositor opens up a keen HSA and labels beneficiaries in both the new HSA arrangement or even in the lending company’s info, the new FDIC do insure the newest put within the Faith Membership class. An enthusiastic HSA, like most most other deposit, is actually insured based on who owns the amount of money and you will whether beneficiaries have been called.